Hi, I'm Nader Anwer

SEO Consultant

Web Entrepreneur

Results-driven SEO approach based on data and analysis developed over 4+ Years of experience! Lets work together!

My Services

Techncial SEO

Have a technical issue? Lets make your website Google friendly!

Link building

Let me establish your website authority on the web

SEO Consultancy

Get a professional audit and strategy for your website

Nader Anwer

I am results-driven SEO Professional and A Digital Entrepreneur who worked on 100+ SEO projects during my 4+ years of experience!

In my free time I love building personal SEO assets, and digging through the SERPs to uncover hidden gems!

My Areas of

Expertise

SAAS SEO

Show your Startup to the world and build a brand using SEO

Ecommerce SEO

Leverage your Ecommerce store via organic search

Local SEO

Dominate the local SERPs, local Packs and your local market

Semantic SEO

A scientific SEO approach based on research, Google patents and NLP

Programmatic SEO

A cost-effective way for scaling faster in a short time

Update Recovery

Your website got hit by A Google Update? Let me fix it

Portfolio

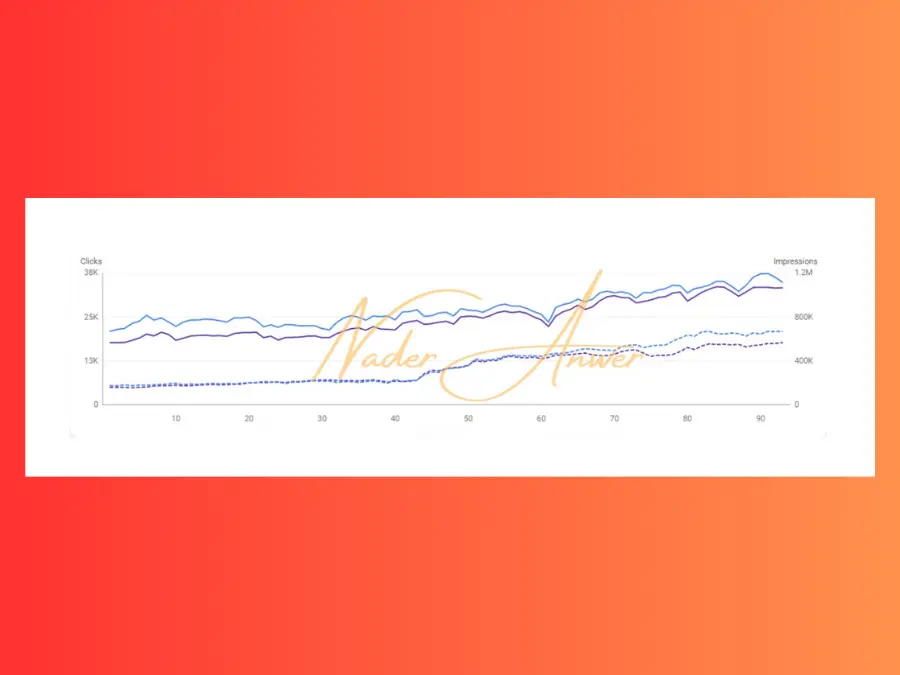

Affiliate SEO Website in the US

Using well-crafted content strategy I managed to take this affiate website from 20k of visits in 3 months to 30k visits in the next 3 months in the Electronics & Gadgets niche in the US market. key strategies used in that project are:

Content Planning

Keyword Clustering

Internal Linking

Schema Markup

Featured Snippet Optimization

Law Firm SEO Project in Saudi Arabia

By leveraging topical authority and precise search intent targeting, I managed to achieve a 110% growth in traffic within 3 months while ranking in page one for the top 20 target keywords with weak Backlink Profile. key strategies used in that project are:

Search Intent Interpretation

Content Planning

Featured Snippet Optimization

Broad Appeal via multi-languages

GMB Optimization

Fitness Ecommerce Store in the US

By targeting multiple marketing funnel via product, category, subcatory, and content pages, in addition to enabling accessibility, and performance, I managed to get this fitness ecommerce store in the US market. Key strategies used in that project are:

Internal linking

Accessibility Optimizaton

Schema Markup

keyword research

Buyer Journey tracking

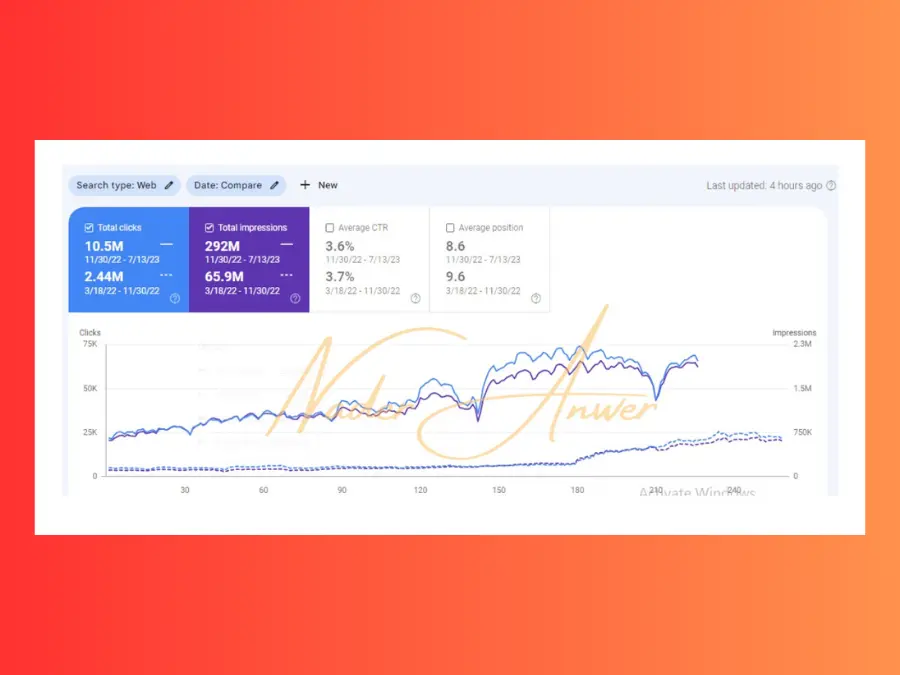

Arabic Medical Informational Website

By leveraging topical authority in the medical sector in addition to optimizing for featured snippets with search intent interpretation and clustering, I manged to drive 300% growth rate for this informational website within 8 month. Key strategies used in that project are:

Content planning

Multi-intent targeting

Intent Clustering

Internal Linking

Topical Clustering

Programmatic SEO Project - US Market

Using programmatic SEO for bulk publishing after preparing a content plan with templated information points, I managed to get this website from 0 to 1800 visits in 15 days only! Key strategies used in that project are:

Bulk keyword research

Programmatic SEO

Simple web scraping

Data analysis

Micro-optimizations

HVAC Local SEO Project - Atlanta, Gorgias, US

By optimizing for Google Local Pack, Local Map as long as organic results I managed to get this local HVAC business to 300% growth rate within 4 months. Key strategies used in that project are:

GMB Optimization

Local Citations

Guest posts

Social bookmarks

Local Content Writing

Get in Touch

Get In Touch!

I am Happy to Hear From You!Whether you want to work directly with me, want a professional consultation, not sure SEO is for your business, or just have an inquiry, I am happy to hear from you!

Whatsapp: https://wa.me/+201068525699 Email: naderanwer10@gmail.com